Silver as a long-term investment

When investing in precious metals, silver often receives less attention or is forgotten altogether. Sometimes the feeling arises that only buying gold is a "real" investment. Yet the old silver shillings, silverware or silver bars are considered a sensible investment and an "iron reserve". Like gold, the price of silver peaked in 2011 and has risen in value by almost 660% since 2001 - more than gold in the same ten years! However, the value of silver subsequently fell again by more than 50%. In the summer of 2020, the price of silver then rose again enormously - in parallel with gold's all-time high.

A similar phenomenon can be observed with the silver price as with the gold price: the greater the uncertainty in society, the more the price of silver bars and silver coins rises. However, there are a few things you should bear in mind when buying silver. Advice from a reputable dealer is crucial here.

7 good reasons to buy silver

- Silver is an undervalued precious metal

- You can invest in silver with small amounts of money

- Sustainable increase in the value of silver through scarcity (industry)

- Double hedging through nominal and silver value

- Independence from banks and financial institutions (keyword: creditor liability, state access to accounts)

- You own physical assets (currency is only paper - without security)

- Spreading the risk in times of crisis

Silver price: What should you look out for when buying silver?

If you would like to invest your money in silver, we can recommend the following three products in particular:

When buying coins, you benefit from a decisive advantage: due to the high difference in value between the silver price and the gold price, there is only a small difference between the face value of silver coins and their silver value. This means that you benefit from a double hedge when selling: if the silver price falls sharply, silver coins retain their face value in any case. This is one reason why the old silver shillings are still so popular in Austria. At the same time, the higher the price of silver, the more valuable silver coins are. You also benefit from the following advantage: the price of silver. The price of a fine ounce of Vienna Philharmonic silver is just a few euros, making it possible to invest on a small budget.

Silver investment: Buying silver - but in what form?

When buying silver, the question is not whether you invest, but how much you invest in silver and in what distribution. It generally makes sense to spread the risk between different precious metals. A silver investment is even more successful if you hedge within the precious metal. You therefore select products that have an intrinsic value (nominal value) and a precious metal value (silver value). The question of whether you have already invested in silver also plays a role here, and if so, in what amount and form. This information is relevant in order to find the right offer for you.

A reputable precious metal dealer will advise you in detail and point out the advantages as well as the disadvantages of their products.

The precious metal experts at Gold & Co. will be happy to take time for you and provide you with expert advice on all questions relating to buying silver:

- Do you invest in silver coins or silver bars?

- Which denomination or sorting do you use within these product classes? For example, do you buy silver shillings or the Vienna Philharmonic ounce?

- What denomination makes sense in your phase of life?

- How and where do you store the silver?

- When is the right time to invest and at what price?

- Which products are suitable for resale and what are the price differences?

- How do you achieve the best flexibility at the best price/performance ratio?

- How high is the taxation on silver investments?

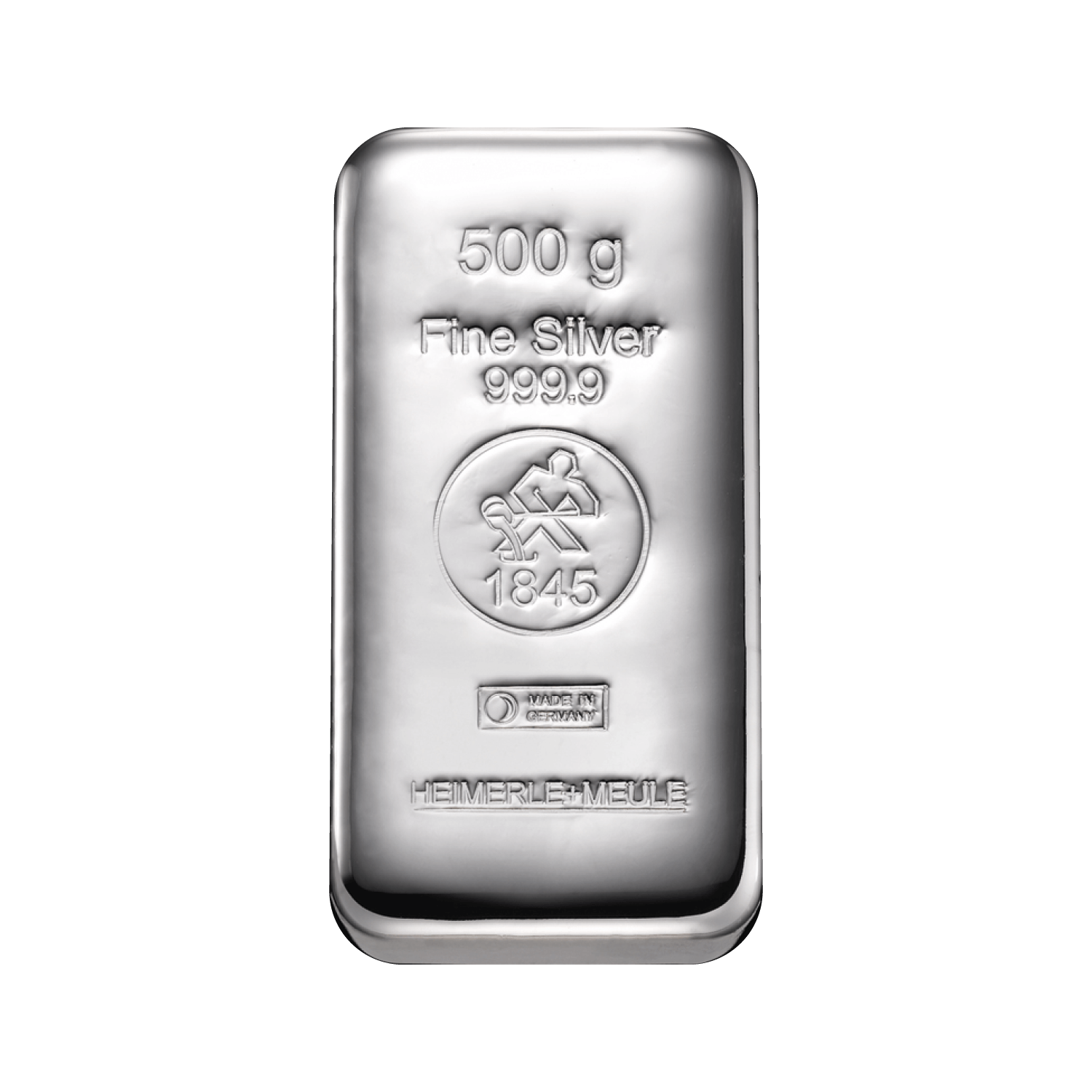

Buying silver bars as an investment

- Do you buy certified silver bars?

- How much money do you invest in silver and why?

- How and where do you store the investment bars?

- How do you achieve the best flexibility at the best price/performance ratio?

Investing money in silver bars or coins means thinking long-term. It is an undervalued precious metal and can rise sharply in value while the purchasing power of money continues to fall. The world's silver reserves are limited and are also being depleted by the industry. This means that even if there is an oversupply, the price can hardly fall - similar to gold coins or gold bars.

The family business Gold & Co. can look back on 130 years of tradition as a precious metal dealer in Austria. Benefit from our experience and let us advise you in a free consultation.

Are there any disadvantages to buying silver?

A reputable precious metal dealer will also inform you about the disadvantages of investing in silver. Unlike gold, silver is not exempt from VAT. The VAT on silver investments is 20%. This means that the price must rise by 20% for an investor to exit with a 0% profit.

Our tip: Silver can be bought with differential taxation, e.g. in the form of silver shillings. Another advantage of silver shillings is that they are always hedged against total loss with the nominal value.

As an investor, you should know that silver is subject to greater price fluctuations than gold due to its use as an industrial metal. However, it also has a higher leverage in times of rising prices.

Buy silver Austria - "The gold of the little man"

Similar to gold coins or gold bars, silver coins have been used as a means of payment for thousands of years. The Greeks, Romans and Egyptians already appreciated the coveted precious metal and used it as a stable investment. There were times in history when silver was even worth more than gold! Nowadays, silver is often used in industry and is undervalued as a precious metal. Gold is currently around 80 times more expensive than silver, which is why silver is much more affordable than gold. You don't always have to start with large investments. Investing small amounts as an alternative is better, especially at the beginning, than not investing at all. You can start with small amounts of coins and bars. You should bear the following in mind: silver is currently undervalued. And the world's silver reserves are now relatively small. Likewise, silver cannot be produced artificially and the increased use of the raw material in industry is resulting in a slow but sustained increase in value. Since 2001, the value of silver has increased more than sixfold, rising from 140 dollars per kilo to 880 dollars per kilo (August 2020). This corresponds to an increase in value of around 740 euros per kilo.

A silver investment is not suitable for short-term speculation. We strongly advise against this. However, if you want to invest your money in precious metals in the medium or long term, you are on the safe side with an investment in silver or gold.