In history, it has happened time and again that the state has prohibited private individuals from trading in and / or owning gold, has restricted this or sanctioned it with custodial sentences, fines and administrative penalties. Again and again economists warn of a coming gold ban. But is such a ban on gold really realistic?

What does gold ban mean anyway?

In the case of a gold ownership ban, private individuals are obliged to sell their gold (at least bullion coins and bars) to the state at a fixed gold price.

Only the possession of gold jewelry and partly of collector coins is mostly legal up to a legally regulated upper limit.

In addition, a trade ban for gold, silver and other precious metals is often enforced, so that coins and bars may not be traded, or only with special permission (trade).

Historical gold bans

Time and again in history, gold ownership by ordinary citizens has been banned by the authorities. Gold bans were not only enforced by authoritarian or totalitarian states, but also in established democracies.

In early antiquity, gold and silver were often still forbidden to people because it was considered to have divine or royal symbolism.

Later, however, gold bans were always a means of controlling one's own currency or getting a grip on state finances: This began in Caesar's Rome and continued through the Chinese Empire to revolutionary France.

Gold bans in the 20th century

In the 20th century, too, gold bans can be found in numerous countries around the world. In the Weimar Republic, private gold ownership had already been restricted in 1923. Under the Nazis, not only was private gold ownership banned in Germany and Austria, but trades were also prohibited from owning certain precious metals. German "Devisenschutzkommandos" were on the way to confiscate gold, silver as well as other values or to buy them compulsorily.

After the war, the victorious powers then imposed a ban on gold, which remained in place until 1955.

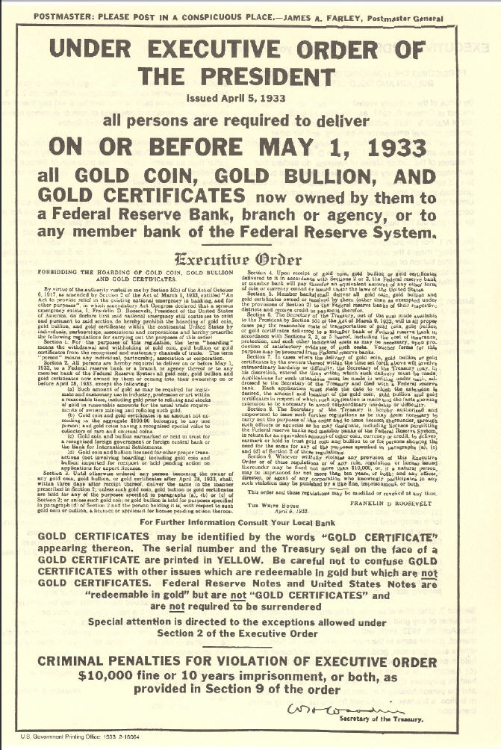

One of the best known, however, is the Emergency Banking Act of 1933, with which U.S. President Franklin D. Roosevelt declared private gold ownership in the U.S. illegal. Roosevelt declared private gold ownership in the USA illegal.

By presidential decree, all private gold had to be sold to the state within 14 days at a set gold price of $20.67/ounce.

Then in 1961, President Eisenhower also banned U.S. citizens from owning gold abroad. It was not until 1974 that the ban on gold in the United States was lifted again.

After the Second World War, gold bans remained nothing out of the ordinary in many countries: In 1963, India issued a ban on the possession of gold with the aim of improving its own foreign exchange situation; from 1966, a gold ban was in force in Great Britain for several years. British citizens had to hand over their gold to the Bank of England so that it could hedge the British pound.

Is a gold ban looming again?

Historically, gold bans were usually intended to rehabilitate a precarious state of government finances or were used as a monetary policy tool to stabilize one's currency.

Once again, many countries are facing enormous challenges: The Corona pandemic led to enormous cuts in the economy and society. To get the economy going again, countries are investing billions and central banks are providing cheap money. As a result, the money supply is inflating more and more, which will lead to increased inflation in the long term.

Because commercial banks are increasingly passing on negative interest rates to their customers, savings in the account are threatening to become less rather than more.

If you lose confidence in other forms of investment, they flee to the safe gold. The same applies to money in general. If people lose confidence in the stability of a currency, gold becomes a "refuge currency" to preserve the value of the wealth they have earned. This is because gold is considered a safe haven. It has preserved its value for centuries.

To prevent such a flight into precious metals, a gold ban would therefore be quite conceivable. Moreover, it would be the logical continuation of a cash ban. Recently, there have been repeated attempts by the EU, the ECB and the IMF to introduce cash ceilings. Critics, however, fear that such restrictions on cash payments could be the first step toward a complete ban on cash. Such cash limits also go hand-in-hand with tighter restrictions on anonymity when buying gold.

Legally, there are probably already regulations in Austria that would allow the enforcement of a gold ban:

For example, according to the Scheidemünzengesetz, the Austrian Mint is not only entitled to "mint and [...] put into circulation"Scheidemünzen and commercial coins in accordance with this federal law, but also to "withdraw" them(Scheidemünzengesetz § 2).

To this end, the National Bank may, according to the Foreign Exchange Act, "declare legal transactions and acts to be subject to approval or prohibit them in part or in their entirety."(Foreign Exchange Act § 4 (1)). This also expressly applies to gold, namely to "fine gold and alloyed gold (raw or as semi-material), gold coins which have been withdrawn from circulation or are no longer negotiable, as well as claims and obligations for the delivery of gold"(Foreign Exchange Act § 1 (1) 5).

What speaks against a gold ban

Even though gold bans were often profitable for the state, history also shows that such ownership bans were always very difficult to enforce. Many citizens preferred to hide their gold rather than hand it in to official authorities, and the trade in gold and silver flourished even when it was banned.

Not only would a ban on gold ownership be a huge encroachment on constitutionally guaranteed property rights, but the enforcement of such a measure would require drastic means and would probably be extremely unpopular with voters.

Today, there are much more effective ways for the state to access its citizens' assets than a gold ban. In fact, other asset classes - bank accounts, custody accounts, but also real estate - are also much more directly exposed to the state's access than is the case with private gold reserves and are therefore a much more worthwhile target for state coercive measures.

Such measures range from a simple increase in taxes or the introduction of new compulsory levies, to a ban on trading certain financial products, to a surprise currency exchange.

Physical gold: Safe even in the event of a gold ban

Even if a gold ban seems unlikely: Anyone who wants to secure their assets by buying gold should definitely buy physical gold in the form of gold coins and gold bars. Only this can be safely withdrawn from the grasp of the state even in the event of a ban.

In order to leave no traces, it is also recommended to buy gold anonymously. In Austria it is currently (still) possible to trade gold up to 9,999 euros completely anonymously, in Germany and other EU countries this anonymity limit is already significantly lower.

Gold allows high value to be concentrated in a relatively small space, making it not only easy to store or hide, but also relatively easy to transport.

When storing gold, however, bear in mind that it may not always be accessible in a safe deposit box and that identification is also required at domestic banks.

If you fear a gold ban, it is safer to store your gold at home - in a safe or a good hiding place. It is also possible to store gold abroad to protect it from government access.

When it comes to the denomination of the gold investment, the specific situation of the buyer is always relevant. A coarse denomination - for example, several large bars - is more cost-effective, but a smaller denomination in coins and bars can not only be divided into several stashes, but can also be turned into money again individually if the worst comes to the worst.