With the recognition of the eastern Ukrainian "People's Republics" and the deployment of "peacekeeping troops" by Putin's Russia, the Russia-Ukraine conflict, which has been smoldering for weeks, now seems to be escalating. While share prices and other securities slumped on stock exchanges around the world, gold is once again living up to its reputation as a crisis currency.

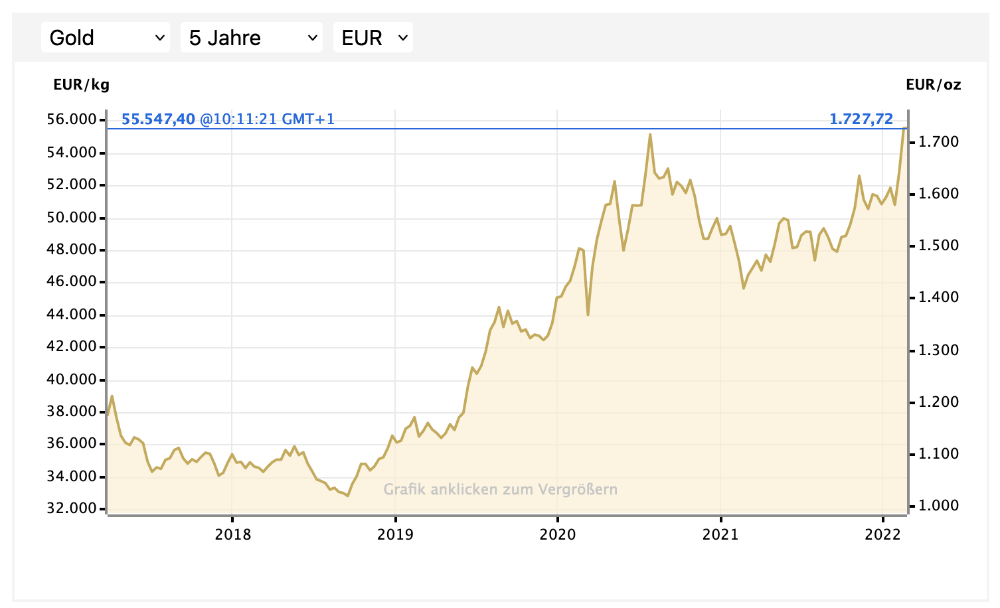

The price of gold in recent months

In recent months, the price of gold has settled at around 1,800 dollars or 1,600 euros per troy ounce.

Recently, however, the gold price remained below the expectations that numerous experts had for the precious metal due to the high inflation rates in the U.S. and the EU. This now seems to change with the escalation of the Russia-Ukraine conflict. In recent days, the price rose massively and reached the highest level in more than 9 months.

Update 24.02.22: Russia's actual attack on Ukraine also plunged the stock markets into chaos. Since some investors are now taking refuge in the crisis currency gold climbed further on Thursday and reached a new all-time high in euros at 1736 euros / troy ounce (intraday). And also in dollars, the all-time high of August 2020, which is so far at 2,063 dollars / ounce, is no longer far away.

Gold as a crisis currency

Gold has always been considered a safe haven in troubled times. Because in economically uncertain times, as well as geopolitical crises, it is not short-term profits that are the top priority, but the general stability of value of precious metals.

Even though the price of gold is generally subject to fluctuations, there is never a complete loss of value. With a gold coin, you could be sure throughout human history that you were holding something valuable in your hands.

Even though the price of gold is generally subject to fluctuations, there is never a complete loss of value. With a gold coin, you could be sure throughout human history that you were holding something valuable in your hands.

At least as a safety cushion against systemic and political risks, gold is therefore also part of the portfolio of more and more professional investors. Instead of quick returns in the form of interest and dividends, the gold investment is intended to serve as a buffer and hedge.

What the escalation in Ukraine means

How the gold price develops in the short and medium term is indeed likely to depend very much on developments in the Russia-Ukraine conflict. By formally recognizing the separatist regions of Luhansk and Donetsk and sending troops to these regions, Putin initiated the next stage of escalation.

The sanctions with which the EU, the USA and other countries are now punishing Russia will not only affect Russia, however, but will also lead to economic problems in the West.

In particular, Europe's dependence on Russian gas supplies could cause the price spiral to continue. After all, with the aggression policy, the Nord Stream 2 pipeline is no longer politically tenable. Further energy price increases would cause consumer prices to rise even further, and together with a further lax monetary policy by the ECB, inflation in the euro countries would escalate even further.

If a military confrontation between Russia and the West does occur, the economic problems could of course be accompanied by other developments, ranging from massive refugee movements to further military conflicts in the middle of Europe.

What this means for the gold price development

It can be assumed that the gold price will be further fueled by the developments in Ukraine and especially by the economic consequences. Behind the higher price is the high demand, which indicates massive capital shifts towards crisis-proof gold.

It is certainly noteworthy that cryptocurrencies failed to assert themselves as a digital crisis currency and the price for Bitcoin and Co joined the negative trend on the stock markets.

However, we have seen time and again in the past that after a rapid rise in the gold price in the wake of geopolitical tension, there is also profit-taking and when there are signs of easing, the price also falls back again quickly.

In the medium to long term, the monetary policy of the Fed and the ECB is likely to continue to have the greatest influence on the gold price trend. As long as inflation rates remain at record levels, gold will remain attractive as a store of value.

What to do? Buy or sell gold?

Aber was bedeutet das konkret? Sollte man nun Gold kaufen und auf ein weiteres Anziehen des Goldpreises setzen, oder doch den aktuell hohen Preis nutzen, um Gold zu Geld zu machen?

Wer altes Gold in Form von altem Schmuck, Ketten, Ringen oder auch Zahngold zuhause hat, sollte sicherlich den aktuell hohen Goldpreis als Chance nutzen, um dieses Altgold zu attraktiven Preisen zu verkaufen (auch der attraktive Umtausch von Altgold in Anlagegold ist bei Gold&Co. möglich!).

When buying gold, it is generally difficult to determine an optimal time to buy. In any case, you should consider gold as a long-term investment and not as a speculative object.

However, since we assume that the gold price will develop positively in the longer term in any case - see our gold price forecast - you can still (re)buy gold now.

If you want to buy gold as a security or for long-term wealth accumulation, we always advise to buy smaller amounts of gold at regular intervals. In any case, we advise to buy physical gold in the form of coins and bars. With this purchase strategy, price fluctuations can then also be well balanced out.