Durch die Pandemie und die Maßnahmen dagegen befinden wir uns bereits in einer wirtschaftlichen Rezession. Die Konjunktur in quasi allen Industriestaaten ist im letzten Jahr eingebrochen und auch 2021 droht ein negatives Wachstum.

Staaten und Zentralbanken versuchen aktiv gegen diese Krise zu steuern, pumpen unvorstellbare Mengen an Geld in den Wirtschaftskreislauf und halten die Zinsen weiter unter Null. Als Folge dieser Maßnahmen droht Inflation das Vermögen der normalen Bürger zu vernichten.

Was bedeutet Inflation überhaupt?

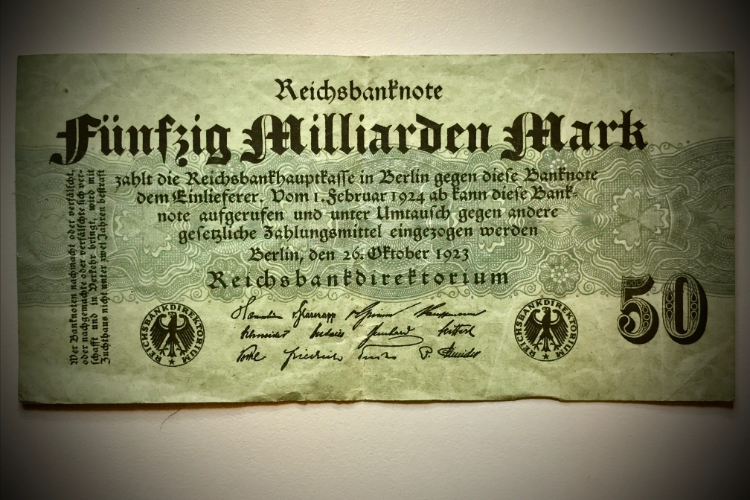

Inflation beschreibt eine allgemeine Teuerung. Waren und Dienstleistungen werden teurer, bzw. die Kaufkraft des Geldes sinkt. Kurzum: Das Geld in der Börse oder auf der Bank wird weniger wert. Die Inflation kann dabei aktiv von den Zentralbanken gesteuert werden. Denn die Zentralbanken steuern durch ihre Zins- und Geldpolitik, wie viel Geld im Wirtschaftskreislauf ist. Je größer die Geldmenge und je niedriger die Leitzinsen, desto höher das Risiko der Inflation.

Zwar ist die Wahrung der Preisstabilität das oberste Ziel vieler Zentralbanken, wie zum Beispiel der Europäischen Zentralbank EZB, doch ist eine leichte Inflation (offizieller Zielwert der Inflationsrate 2%) dabei durchaus gewünscht. Denn das Gegenteil der Inflation, die Deflation, fürchten Ökonomen noch mehr. Denn wenn Preise sinken schieben Konsumenten sowie Unternehmen ihre Kaufentscheidungen in der Hoffnung auf noch tiefere Preise immer weiter in die Zukunft.

Krise und Inflation

Um der Finanz- und Staatsschuldenkrise nach 2008 gegenzusteuern haben die amerikanische FED und die EZB, ein Zeitalter der ultralockeren Geldpolitik und der Niedrigzinsen eingeläutet.

Durch Leitzinsen von Null- und Negativzinsen, soll es für Geschäftsbanken unattraktiv sein, Geld bei der Zentralbank zu lassen. Stattdessen sollen Unternehmen und Verbraucher günstig Kredite aufnehmen können, die die Wirtschaft ankurbeln bzw. am Laufen halten soll.

Durch staatliche Rettungs- und Konjunkturprogramme pumpten und pumpen auch die Staaten enorme Mengen an Geld in den Markt.

Die Niedrigzinspolitik und das Aufblähen der Geldmenge (Quantitative Easing) werden als Werkzeug gegen die Krise eingesetzt. Jedoch steigt damit auch das Risiko der Inflation.

Corona Krise: Rezession und Inflation

Nun fahren EZB, FED und Co ihre Zins- und Geldpolitik schon mehr als einem Jahrzehnt. Stets gab es auch mahnende Stimmen, die vor einer Inflation warnten. Trotzdem trat das Szenario bisher nicht ein. Was ist nun anders?

Nach der Finanzkrise 2008 und der Euro- und Staatsschuldenkrise – betroffen waren vor allem ja die europäischen Südländer: Griechenland, Spanien, Italien & Portugal – half die Geld- und Zinspolitik tatsächlich „das Ruder herumzureißen“.

Danach allerdings traute man sich nicht diese Art der Geldpolitik wieder zu beenden: Das Geld blieb weiterhin billig. Jedoch floss das Geld weniger in die Realwirtschaft, als dass es von Anlegern und Investoren genutzt wurde, um an der Börse zu investieren.

Weil also das „überschüssige“ Geld vor allem in den Finanzmarkt floss und nicht bei der Masse der Menschen ankam, hielt sich auch die Inflation in Grenzen.

Durch die Corona-Krise und die Maßnahmen, um der Pandemie entgegenzuwirken, befinden wir uns nun wieder in einer Rezession. Und wieder pumpen Staaten und Zentralbanken enorme Gelder in die Wirtschaft. Jedoch diesmal nicht in Form von Krediten, sondern auch vermehrt in Form von direkten Zuschüssen, Subventionen und barem Geld auf den Konten der Menschen. Mit dem klaren Ziel den Konsum am Laufen zu halten (= “Helikoptergeld“).

Fließt dieses Geld tatsächlich in den Konsum, dürfte auch die Inflation kommen.

Das viele Geld wird von den Notenbanken durch das Anwerfen der Notenpresse herbeigeschafft, was sich auch an der Gesamt-Geldmenge (M3) verfolgen lässt. In den USA ist allein im Jahr 2020 das Geldvolumen um ein Viertel angestiegen. Und auch in Europa hat sich die Geldmenge von etwa 4 Billionen Euro (Ende 2019) auf nun 11 Billionen Euro (Ende 2020) vervielfacht.

Was bedeutet Inflation für den Sparer?

Für den einfachen Bürger bedeutet Inflation, dass Geldvermögen mit der Zeit an Wert verliert. Sobald die Banken – einige tun dies bereits – die negativen Leitzinsen auch an den Sparer weitergeben, verliert das Geld auf dem Konto noch mehr an Wert.

Für den klassischen Durchschnittsbürger mit dem Vermögen am Sparbuch bedeutet das eine schleichende Enteignung.

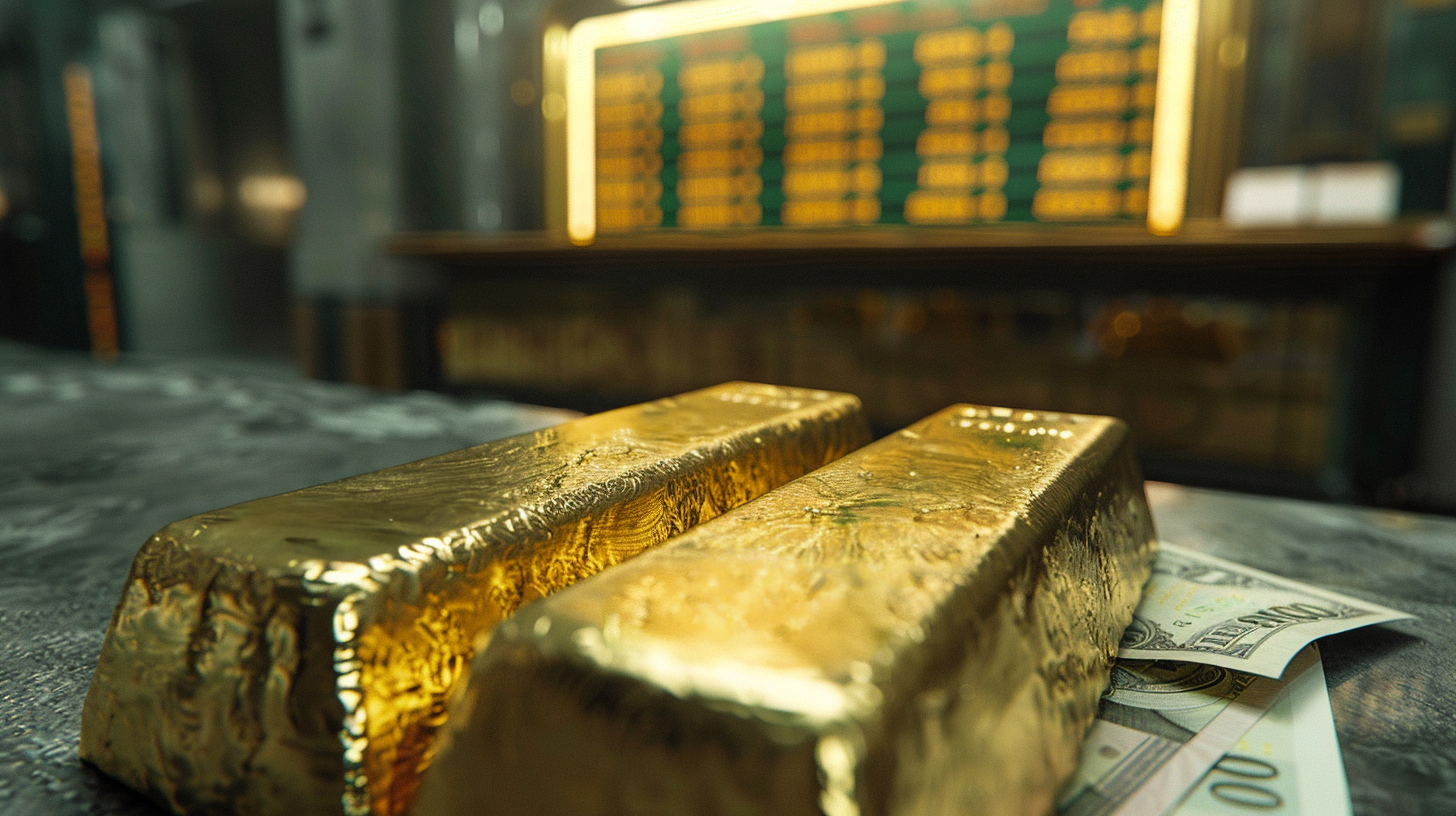

Wenn Geld an Kaufkraft verliert, gilt es zu retten, was zu retten ist. Um das eigene Vermögen zu schützen bieten sich für Sparer und Anleger Sachwerte an: Dazu gehören neben Immobilien vor allem Edelmetalle, wie Gold und Silber.

Gold gilt als die stabilste Währung überhaupt. Gold eignet sich daher als „wirtschaftliche Selbstverteidigung“. Eine Verteidigung gegen die Entwertung Ihres Geldvermögens.

Gerade in Zeiten voranschreitender Geldentwertung bietet Gold Sicherheit und dient als Inflationsanker.

Anders als mit Geld, können Sie sich heute mit einer bestimmten Menge Gold, dasselbe leisten wie vor hundert Jahren: Ein bekanntes Beispiel dafür ist ein hochwertiger zweiteiliger Herrenanzug – Heute, vor 50, vor 100 oder auch vor 150 Jahren bekam man für den Gegenwert von 1 Unze Gold stets einen guten Herrenanzug.

Goldpreis & Inflation

In Zeiten erhöhter Inflation bzw. schon bei erhöhter Inflationsgefahr flüchten auch zunehmend Anleger in den „Sicheren Hafen Gold“. Dementsprechend steigt durch diese zunehmende Nachfrage der Goldpreis zusätzlich.

Zusätzlich deshalb, weil sich ja allein durch die Wertbeständigkeit von Gold im Gegensatz zum Kaufkraftverlust von Euro oder Dollar das Verhältnis zwischen den Währungen und dem Goldkurs verändert.

Es daher damit zu rechnen, dass der Goldpreis 2021 und in den kommenden Jahren weiter steigen wird. So rechnen etwa die Analysten der Großbank Goldman Sachs heuer mit einem Goldpreis von 2300 Dollar, der Goldbarrenhersteller Argor-Heraeus rechnet mit einem Goldpreis von 2200 Dollar.

Auch die beiden Goldspezialisten von Incrementum, Ronald Stöferle und Mark Valek, gehen in ihrem „In Gold We Trust Report 2020“ gar von einer „goldenen Dekade“ aus und rechnen langfristig damit, dass der Goldpreis im Jahr 2030 konservativ geschätzt bei etwa 4.800 US-Dollar liegen wird.

Mit einer Investition in Gold sind Sie jedenfalls immer auf der sicheren Seite! Gold ist aufgrund seiner begrenzten Verfügbarkeit seit vielen Jahrhunderten ein bleibender Wert. Darauf können Sie sich verlassen!