Tips for storing precious metals

Anyone who decides to invest their money in physical gold, silver or other precious metals must - unlike investors who invest in shares, funds or other financial products - think about the storage of their physical assets.

In principle, there are various options for storing gold, all of which have certain advantages and disadvantages. In addition to the aspect of secure storage, aspects such as accessibility, anonymity and insurance also play a major role in gold storage.

What options are there for storing gold?

The first decision is always whether you want to store the gold in your own home or choose a safe deposit box with a third party.

There are basically the following variants:

- Hide the gold at home

- Using a safe to store gold at home

- Storing physical gold in a safe deposit box

- Storing gold with a bank-independent safe deposit box provider

Storing gold at home

Storing gold within your own four walls has the advantage of having access at all times and therefore full control over your own gold reserves. Home storage is also the most cost-effective way to store gold, as there are no ongoing costs for a safe deposit box or safe. The disadvantage is that you have to worry about security yourself.

Storing gold at home in a safe

If you decide to store your gold coins, gold bars and other valuables at home, you need to consider whether you should lock them in a secure safe or find a good hiding place in the house instead.

The safer way to store gold at home is to store gold bars and coins together with other valuables in a safe. Of course, you have to make sure that the home safe is solidly constructed (observe VdS/EN classes!). Up to a weight of around 600 kilograms, the safe should be firmly anchored in the floor or wall so that burglars cannot simply carry the safe away.

A simple safe from the DIY store offers hardly any security and can be cracked by a semi-professional in just a few minutes - there are plenty of videos on YouTube!

The main disadvantages of a (good) safe are the not inconsiderable purchase costs (2000-4000 euros) and the fact that a prominent safe naturally gives potential burglars an indication of the valuables stored in it. In any case, we recommend well-known brand safes that are also recommended by insurance companies, such as Wertheim, Putz or - somewhat cheaper but just as secure - PRIMAT from Slovenia.

You can find out more about safes here

Hiding gold at home

An alternative way to store gold at home is in good, secure hiding places. Here, too, you have direct access to your gold and can access it at any time. As there is no need to purchase an expensive safe, this form of storage is certainly the most cost-effective. But it is also the riskiest.

Think carefully about where you want to hide your gold at home. Supposedly good hiding places, such as false bottoms in drawers or in the toilet cistern, are well known to cunning burglars. Children, family members and cleaning staff should also not stumble across your gold reserves by chance.

Good hiding places are usually hidden cavities, double walls or actually burying the precious metals in your own garden. In any case, remember to protect your precious metals from moisture and heat.

A good compromise between hiding places and safes can be small socket or pipe safes that are concealed in walls or floors.

In any case, divide your valuables into several hiding places and think carefully about who you tell. But also bear in mind that you could lose the memory of your hiding places due to a stroke, dementia or simply "normal forgetting". This could be remedied with a notarized "treasure map".

Depositing gold in safe deposit boxes

If you don't want to worry about the safekeeping of physical precious metal investments, you can store your own gold and silver reserves in bank safe deposit boxes or with private safe deposit box rental companies.

Storage abroad is also conceivable in order to protect gold bars and gold coins from government access. The major disadvantage is that your own gold is then not immediately available.

Storing gold in a safe deposit box

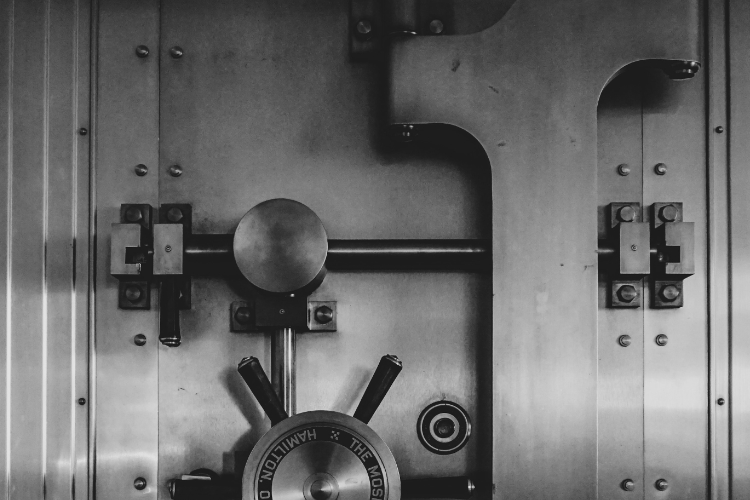

The classic option for storing gold is certainly to keep it in a safe deposit box at a trusted bank. Precious metals are deposited in banks in a safe deposit box, which is usually more expensive than a normal passbook safe deposit box. Incidentally, it is neither intended nor insured to store precious metals in a safe deposit box.

In addition to the annual rent, there may also be opening fees and additional insurance benefits.

If you store your physical precious metals in a safe deposit box, you don't have to worry about the security of your valuables. They are safely stored behind the thick walls of a bank vault. There is no need to worry about break-ins.

The main disadvantage of a safe deposit box is its accessibility. You only have access to your property during the bank's OPENING HOURS . In addition, identification is required at domestic banks.

Storing gold in private safe deposit boxes

An alternative to bank safe deposit boxes are therefore private, bank-independent safe deposit box providers. For a significantly higher fee, these companies offer access to your own safe deposit box around the clock, seven days a week, using your own key, code or card.

For a surcharge, some providers also offer completely anonymous safe deposit boxes, but due to the new money laundering laws, this will probably soon no longer be possible, just like our good old anonymous savings book.

In Vienna , for example, there is the "Tresor" in Palais Coburg, the "Safe" in Auerspergstraße or the company "Spartasafe" in the 3rd district.

The question of whether you want to entrust your gold to a small private company is one that everyone has to ask themselves - although the question is of course also justified in the case of large banks.

If the agreed safe deposit box fees are not paid for a long period of time, banks are entitled to have the safe deposit boxes opened under the supervision of a notary and to use part of the contents to settle the costs.

Private safe deposit box landlords could also secure such rights in the contractual terms and conditions and should therefore be considered.

It is also possible to simply deposit precious metals with lawyers or notaries, although there should be a close relationship and a high degree of trust.

Insurances

As a rule, your gold is covered by household insurance or contents insurance. But beware - some insurance policies exclude investment gold by defining it as "unprocessed gold". However, many household insurance policies require valuables to be stored in a suitable safe or do not pay out the full amount if precious metals are simply stored in a sock drawer.

In the case of bank safe deposit boxes, it is essential to clarify how high the general sum insured per safe deposit box is. If the gold deposit in the safe deposit box is worth more than the basic sum insured, additional insurance should be taken out.

Regardless of whether you store your gold and silver at home or in a safe deposit box, you should always keep an eye on the value of your precious metals. because the price of gold is flexible, it can happen that your coins and bars are suddenly worth more than the insurance covers. In this case, you should urgently adjust the sum insured to the equivalent value of your gold.

In any case, it is advisable to keep documentation, invoices and photos of the gold holdings separately so that there are no problems with the insurance company in the event of an emergency. A photo sent to your own email address on Google, Yahoo or other providers or stored on a cloud storage service such as Dropbox can be accessed later via any internet-enabled computer and serves as a backup. (Incidentally, this is also recommended with various important documents or ID cards before traveling abroad)

Conclusion

In general, it must be said that every form of storage has advantages and disadvantages and there is a separate "loss model" for each variant, as the following examples show:

- Burying gold in the garden: gold is forgotten over the years, the property is sold, or the heirs don't know about it

- Digging in the forest: gold is found by explorers or by chance

- Hidden at home: The hiding place is not good enough and is found

- In the safe at home: burglars find the code or the key - the insurance cover does not apply.

- Safe locked at home - the horror story - home invasion opening by blackmail

- Storage in a safe deposit box: Cyprus 2013 - what more can you say?

- State Gold banIn Europe from 1914-23 & 1930-45, in the USA from 1933-1974

- Storage in a safe deposit box: Without a record, valuables may be untraceable for heirs - the contents of the safe deposit box then fall to the bank.

We generally advise small investors to store their precious metals at home in a secure vault and to insure them well. This way you always have direct access to your gold. If the value of your gold exceeds an amount of around 30,000 euros, you should divide your investment between several locations and store some of your gold coins and bars in safe deposit boxes.

In addition, always keep an eye on the gold price trend so that you know the value of your physical gold and can adjust your insurance cover if necessary.