Goldpreis-Entwicklung

Nachdem der Goldpreis bereits mit ordentlich Schwung ins neue Jahr gestartet war, verzeichnete das Edelmetall im Februar acht weitere Rekordtage. Auf Basis des US-Futures-Handels liegen die Bestmarken nun bei 2.963 US-Dollar bzw. 2.848 Euro. Der Kursrückgang in der letzten Februarwoche sorgte dann aus technischer Sicht für eine gewisse Abkühlung in einem kurzfristig überhitzten Markt.

Wie kann es jetzt weitergehen? Und um es gleich vorwegzunehmen: das Umfeld für eine langfristige Fortsetzung der Goldhausse könnte idealer kaum sein. Sie haben sich in den vergangenen Wochen sogar weiter verbessert, in geradezu tragischer Weise. Aber der Reihe nach.

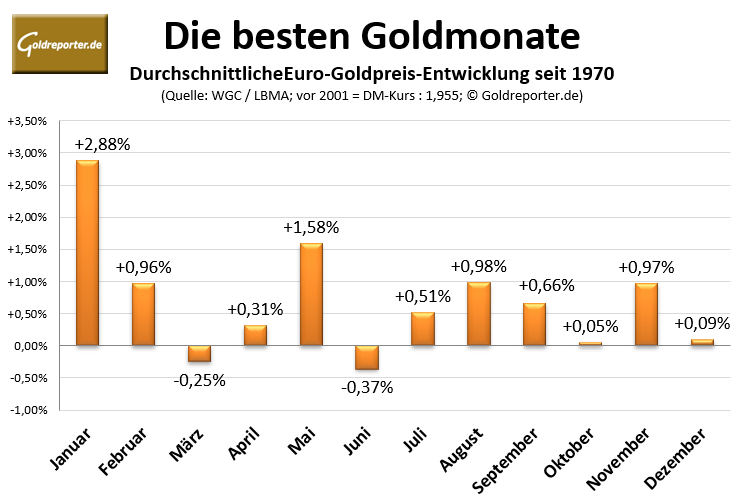

Saisonale Aspekte

Der März gehört statistisch gesehen eigentlich zu den schwächsten Goldmonaten des Jahres. Geht man beim Goldpreis zurück bis ins Jahr 1970, so landet dieser Monat mit einem durchschnittlichen Kursrückgang von 0,25 Prozent auf dem vorletzten Platz. Allerdings spielten saisonale Aspekte in den vergangenen Jahren kaum eine Rolle. In den vergangenen vier Jahren bescherte der März Goldanlegern jeweils Kursgewinne.

Aktuelles Marktgeschehen

Auch zuletzt wurde das kurzfristige Marktgeschehen immer wieder von ungewöhnlichen Ereignissen bestimmt. Dazu gehören die massiven physischen Goldbewegungen in die USA, nachdem institutionelle Händler die Einführung von Importsteuern für Edelmetalle befürchteten und sich teils erhebliche Preisdifferenzen zwischen den Goldbörsen in den USA, Europa und China ergaben.

Eine weitere wichtige Erkenntnis der vergangenen Tage: Wenn der Politik nichts mehr Konstruktives einfällt, dann macht sie einfach neue Schulden, um die strukturellen wirtschaftlichen Probleme zu überbrücken. Das ist der einfachste Weg, um Haushaltslöcher zu stopfen, ohne die Wähler direkt zur Kasse zu bitten.

Massive Defizitfinanzierung

Die finanziellen Folgen des „Deficit Spending“ zeigen sich in der Regel erst mit größerer zeitlicher Verzögerung. Sie äußern sich in finanziellen Belastungen in späteren Perioden (Zins- und Tilgungszahlungen) und befeuern die schleichende Inflation. Außerdem beinhalten sie ein gehöriges Zins- und Umschuldungsrisiko, mit der Gefahr staatlicher Insolvenz, wie wir sie im Zuge der Eurokrise bereits erlebt haben.

Aber diesen Weg will die neue deutsche Bundesregierung einschlagen. Es kursierten Summen von bis zu 900 Milliarden Euro, die sich SPD und Union schnellstens als „Sondervermögen“ absegnen lassen wollen für Rüstung/Verteidigung und Infrastruktur.

Ein ähnliches Vorhaben wird aus Kreisen der Europäischen Union erwartet.

Eines ist dabei sicher: Die Kaufkraft unseres Geldes wird damit weiter kräftig ausgehöhlt und das äußert sich kurz oder lang in einem kontinuierlich steigenden Goldpreis.

US-Politik

Dagegen unternimmt die US-Regierung einen ökonomisch durchaus sinnvollen Versuch, den schiefen Staatshaushalt auf der Kostenseite einzufangen. Allerdings riskiert Trump sowohl mit seiner rigorosen Einsparpolitik als auch mit den erlassenen Einfuhrzöllen, die Konjunktur kurzfristig zu belasten. Auch der Goldmarkt stand bis zuletzt unter dem starken Einfluss der neuen US-Politik. Die Angst vor Zöllen auf Gold und andere Edelmetalle sorgte seit Ende vergangenen Jahres für beispiellose Metalltransfers in die Vereinigten Staaten.

Spannend ist auch die Frage nach dem Verbleib und der Verwendung der US-Goldreserven. Die US-Administration will die amerikanischen Goldbestände prüfen lassen, zumindest von einer Besichtigung war bis zuletzt die Rede. Siehe dazu auch: Das Gold in Fort Knox. Und es gibt eine Idee, wie man durch die buchhalterische Neubewertung des Goldes finanziellen Spielraum im US-Haushalt schaffen könnte. Aktuell stehen die US-Goldreserven mit 42,22 US-Dollar pro Unze in der Fed-Bilanz.

Was passiert mit dem Währungsgold?

Sollte sich herausstellen, dass die amerikanischen Goldreserven nicht in dem Umfang oder nicht in der Qualität vorliegen, wie behauptet wird, dann dürfte das dem Goldpreis nicht gerade schaden. Schließlich basiert der aktuelle Kurs ja auch auf den Annahmen über das weltweit vorhandene und verfügbare Gold.

Eine Neubewertung der Goldreserven in den Haushaltsbüchern des Staates brächte einen kurzfristigen finanziellen Spielraum für die Deckung neuer Ausgaben. Aber gleichzeitig würde man das Edelmetall als Mittel zur Geldschöpfung erneut auf einen geldpolitischen Thron heben, von dem es nach Aufgabe des Goldstandards Anfang der 1970er bewusst verbannt wurde.

Aber womöglich würde eine solche Maßnahme erneut Diskussionen über einen staatlichen Goldverkauf provozieren. Etwa in Europa, wo die finanzielle Not ebenfalls groß ist, wie wir spätestens mit der jüngsten Verhandlung um „Sondervermögen“ erkennen können.

Goldpreis-Prognosen der Banken

Werfen wir einen Blick auf die jüngsten Goldpreis-Prognosen der Großbanken. Laut Saxo Bank-Analyst Ole Hansen hat Gold eine überfällige Korrektur durchlaufen, die auf Gewinnmitnahmen und erhöhte Marktvolatilität zurückzuführen sei. Dennoch bleibe der langfristige Ausblick positiv. Unterstützungsmarken lägen bei 2.813 und 2.790 US-Dollar, bevor ein erneuter Anstieg Richtung 3.000 US-Dollar erwartet werde.

Auch die ANZ sieht den jüngsten Rückgang als Folge von Gewinnmitnahmen. US-Zölle und sinkender Inflationsdruck könnten die Marktstimmung belasten, doch geopolitische Risiken und geldpolitische Unsicherheiten dürften die Nachfrage langfristig stabil halten.

UBS hält an ihrer Goldprognose von 3.000 US-Dollar pro Unze bis Jahresende fest, sieht im Risikoszenario sogar 3.200 US-Dollar. Silber könnte auf 38 US-Dollar steigen, unterstützt durch industrielle Nachfrage.

J.P. Morgan prognostiziert für das vierte Quartal 2025 einen Goldpreis von bis zu 3.000 US-Dollar. Gold bleibe als Inflationsschutz und sicherer Hafen gefragt, gestützt durch Zentralbankkäufe und geopolitische Unsicherheiten.

Goldman Sachs hebt seine Prognose für 2025 auf 3.300 US-Dollar an. Die Bank erwartet weiterhin hohe Zentralbankkäufe und von Zinssenkungen der Fed profitierende Märkte. Sollte die Fed die Zinsen nicht senken, könnte Gold jedoch nur auf 3.060 US-Dollar steigen.

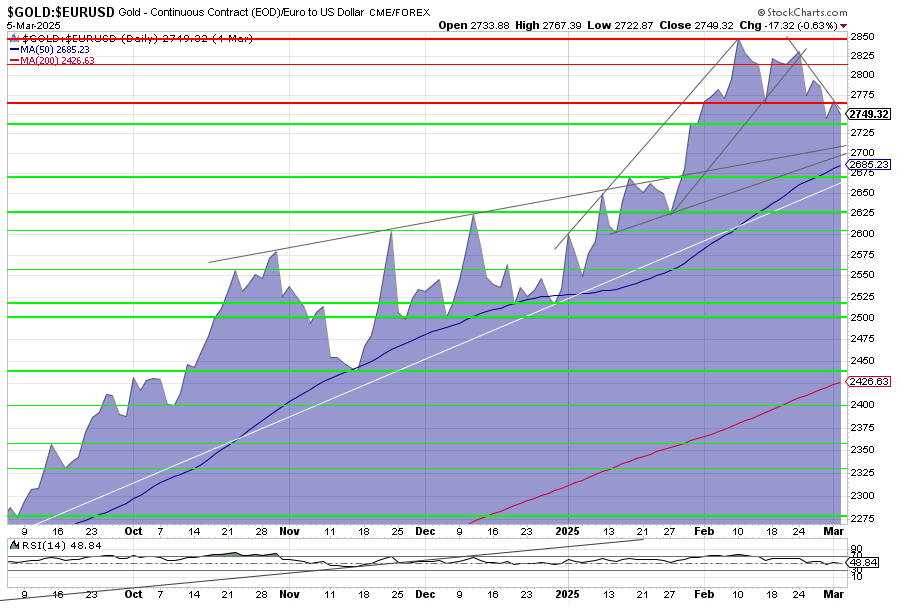

Charttechnik

Werfen wir noch einen Blick auf die charttechnischen Rahmenbedingungen. Am Dienstag schloss der Goldpreis im US-Futures-Handel bei 2.920 US-Dollar pro Unze (April-Kontrakt), was 2.749 Euro entsprach. Nach einem Rücksetzer am vergangenen Freitag auf 2.848 US-Dollar folgte eine rasche Erholung oberhalb der 2.850-US-Dollar-Marke. Die nächste Widerstandszone liegt bei 2.930 US-Dollar.

Das Sentiment hat sich entspannt. Das heißt, Gold ist aus 14-Tage-Sicht derzeit nicht mehr „überkauft“. Dabei blieb der Kurs aber zuletzt 12 Prozent über der 200-Tage-Linie, was das anhaltende Momentum verdeutlicht.

Dagegen sahen wir bis zuletzt eine gedämpfte Entwicklung beim Euro-Goldpreis, aufgrund der deutlichen Euro-Aufwertung. Wichtige Unterstützungen liegen hier bei 2.740 und 2.700 Euro, während 2.760 Euro durchbrochen werden muss, um den kurzfristigen Trend zu drehen. Insgesamt bleibt der seit 2022 beschleunigte Aufwärtstrend bei Gold intakt, bislang ohne Anzeichen übermäßiger spekulativer Überhitzung.

Fazit

Der Goldpreis bleibt trotz kurzfristiger Rücksetzer in einem langfristigen Aufwärtstrend. Saisonale Muster spielen eine immer geringere Rolle, während geopolitische Unsicherheiten und massive Staatsverschuldung weiterhin als Preistreiber wirken. Besonders die finanzielle Lage in den USA und Europa könnte den Goldmarkt nachhaltig beeinflussen – sei es durch eine Neubewertung staatlicher Goldreserven oder durch zunehmende Inflationsängste. Auch die Prognosen der Banken deuten darauf hin, dass Gold mittelfristig weiter an Wert gewinnen könnte. Charttechnisch bleibt die Lage stabil, mit wichtigen Unterstützungs- und Widerstandsmarken, die den nächsten Kursverlauf bestimmen dürften.