Droht eine neue Finanzkrise?

In der vergangenen Woche kam es in den USA zur größten Bankenpleite seit 2008. Der Fall führte vielen Anlegern vor Augen, auf welch wackligen Beinen die Bilanzen vieler Banken stehen und dass das Finanzsystem vielleicht wieder einmal nur einen Schritt vorm Abgrund steht.

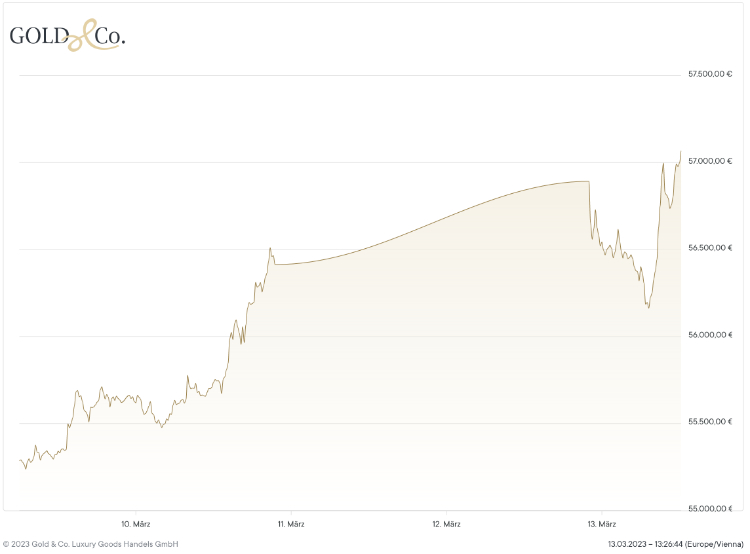

Während die Börsen weltweit tiefrot sind, schnellte der Preis von Gold rapide in die Höhe.

Crash der Silicon Valley Bank: Was ist eigentlich passiert?

Am Freitag meldete die US-Finanzmarktaufsicht, dass kalifornische Silicon Valley Bank (SVB) von den Behörden übernommen und abgewickelt wird. Am Tag zuvor war bekannt geworden, dass sich die Bank verspekuliert hatte, worauf die Kunden ihre Gelder abzogen und die Aktie des Mutterkonzerns abstürzte und schließlich vom Handel ausgesetzt wurde.

Die SVB gilt als Hausbank der kalifonischen Tech-Startups. Diese parkten ihr Cash, die sie zuvor von Investoren eingesammelt hatten, bei der SVB. Die Bank legte diese Gelder dann in vermeintlich sichere Anleihen an, die damals mit etwa 1,8% verzinst waren.

Weil dank der Zinserhöhungen US-Staatsanleihen aber mittlerweile 3,9% Zinsertrag pro Jahr bringen, sank der Wert der Anleihen, die die Bank hielt, deutlich. Das führte bei der SVB zu einem (realisierten) Verlust von 1,8 Milliarden. Der Versuch durch eine Notkapitalerhöhung, also der Ausgabe neuer Aktien, den Verlust wieder zu kompensieren, führte zu Panik und löste einen Teufelskreis aus.

Die Angst vor Banken-Domino

Das entschlossene Einschreiten der US-Behörden und die Zusicherung alle Einlagen bei der Silicon Valley Bank seien geschützt, scheint die Märkte am Montag etwas beruhigt zu haben. Die Verunsicherung aber bleibt hoch. Zum einen herrscht in der Start-up-Szene Panik, schließlich spielte die Bank eine wichtige Rolle in der Tech-Branche, zum anderen fürchtet man das Risiko eines Dominoeffekts im Bankensektor.

Denn nicht nur ist der Zusammenbruch der SVB die größte Bankenpleite seit der globalen Finanzkrise 2008: Die Problematik unrealisierter Verluste durch Anleihen betrifft quasi alle US-Banken. Nach Angaben des Einlagensicherungsfonds FDIC saßen US-Banken Ende 2022 auf 620 Milliarden Dollar an nicht realisierten Verlusten. Mit der Signature Bank wurde am Wochenende auch schon die zweite amerikanische Bank unter staatliche Kontrolle gestellt.

Und auch europäische Banken könnten ähnliche Probleme haben und sich bisher nicht realisierte Verluste in ihren Bilanzen versteckten. Der europäische Bankenindex und die Aktienwerte europäischer Großbanken jedenfalls waren zuletzt tiefrot.

Zwar versuchen alle Beteiligten zu beschwichtigen, dass das Bankensystem deutlich stabiler als 2008 aufgestellt sei und es keinesfalls zu einer neuen globale Bankenkrise kommen wird. Sollten aber in den nächsten Tagen weitere Banken in Straucheln geraten, könnte das allerdings sehr wohl in eine neue Abwärtsspirale führen und zu einem Kollaps des Finanzsystems kommen.

Gold als Krisen-Versicherung

Die Nachricht von der Silicon-Valley-Bank Pleite ließ nicht nur die Aktienmärkte einbrechen. Sie sorgte gleichzeitig dafür, dass der Goldpreis am Freitag nach oben schoss. Gold, dessen Preis in den Wochen zuvor, ob der gestiegenen Zinsen eher rückläufig war, näherte sich damit einem neuen 4-Wochen-Hoch. Das Edelmetall macht damit seinem Ruf als Krisenmetall wieder einmal alle Ehre.

Gold gilt als DER sichere Hafen überhaupt. Durch die generelle Wertbeständigkeit von Edelmetallen eigenen sich Gold, Silber & Co als ideale Krisenreserve. Als Absicherung vor den systemischen und politischen Risiken liegt Gold auch bei vielen professionellen Anlegern mit im Portfolio.

Auch wenn in Krisenzeiten der Goldpreis durch die erhöhte Nachfrage in der Regel eher steigt, stehen bei Gold nicht kurzfristige Gewinne im Fokus, sondern die langfristige Absicherung des Vermögens. Je nach Möglichkeit empfehlen wir 10 bis 20 Prozent des Gesamtvermögens in Edelmetallen anzulegen.

Mein Tipp: Kaufen Sie Edelmetalle stets als echte physische Anlagen. Also In Form von Bullionmünzen und Barren aus Gold und Silber, die Sie selbst in Händen halten.

Papiergold, also Finanzprodukte wie Gold Zertifikate & ETCs, Gold ETFs oder auch Tresorgold, orientiert sich zwar auch am Goldpreis, im Fall des Falles (Bank Run, etc.) kommen Sie aber nicht an Ihr Vermögen.

Jetzt Vermögen mit Edelmetallen absichern

Falls Sie Ihr erworbenes Vermögen gegen Krisen absichern möchten und Interesse an einer Investition in Edelmetalle haben, kommen Sie gerne zu einer kostenfreien und völlig unverbindlichen Beratung durch unsere Goldexperten vorbei.

In einem persönlichen Gespräch machen wir uns ein Bild von Ihren Beweggründen, in Gold zu investieren und erarbeiten darauf aufbauend gemeinsam mit Ihnen eine auf Sie maßgeschneiderte Stückelung und zeigen Ihnen die für Sie idealen Goldprodukte.